With ever-more complex special pricing agreements being created in an already vast and competitive market, the ability to efficiently maintain pricing flexibility between manufacturers and distributors has become essential.

Both supplier and customer rebate have been prominent for many years. Their aim is incentivizing purchases and sales and protecting profit margins. A focus on rebate management has helped merchants, buying groups, wholesale distributors and retailers to drive mutually profitable growth with suppliers whilst improving cash flow and reducing risk.

US-based research has shown that alongside rebate agreements, manufacturers and distributors are increasingly collaborating around ‘special pricing agreements’, commonly abbreviated to SPAs, and often referred to as ‘contract support’ in the UK building materials sector.

By necessity, special pricing agreements are collaborative arrangements whereby manufacturers and distributors assist each other for mutual benefit. Initially these types of agreements entered the market to leverage scale, but they have since evolved into a more widespread tool used to grow sales and market share by allowing trading partners to work together in offering a more competitive price than their rivals.

With special pricing agreements gaining in popularity, and the inherently collaborative nature of these pricing mechanisms, the industry needs to adapt to the times and adopt a more collaborative approach so that these deals can be implemented and administered in a seamless and efficient manner.

However, all too often there is a vast disconnection between manufacturers and distributors, leading to a common duplication of tedious admin work and strained relationships. This can cloud the road ahead and mean that special pricing agreements are seen as a necessary evil in the industry rather than the invaluable method of increasing market share and moving greater volumes of product that they really are.

What is a special pricing agreement?

In simple terms, a special pricing agreement is:

An agreement offered jointly between a manufacturer and a distributor to supply products to a defined market segment at a specially reduced price.

The prices offered might even be loss making for the distributor without the support that they claim from the manufacturer. The manufacturer themselves is likely to be making less profit, but still achieves a sustainable net net profit along with the benefit of increased sales. The defined market segment previously referred to might be a specific contractor or installer, a specific geography, or even a specific installation location or site. The product range that is being discounted is often restricted too.

Typically, special pricing agreements are negotiated between a sales person in the distributor’s branch or pricing department and the manufacturer’s field sales team. Some special pricing agreements are initiated by the manufacturer, some by the distributor, and some by the benefitting contractor or installer.

The possible varieties of special pricing agreements differ depending on the specific manufacturer and distributor involved and the industry that each may be operating in. Although many of these varieties exist, the UK building materials sector typically grapples with three main varieties:

- A certain percentage discounted off of a given price (this is typically list price or invoice price);

- A fixed monetary amount per unit;

- Support to a guaranteed profit margin.

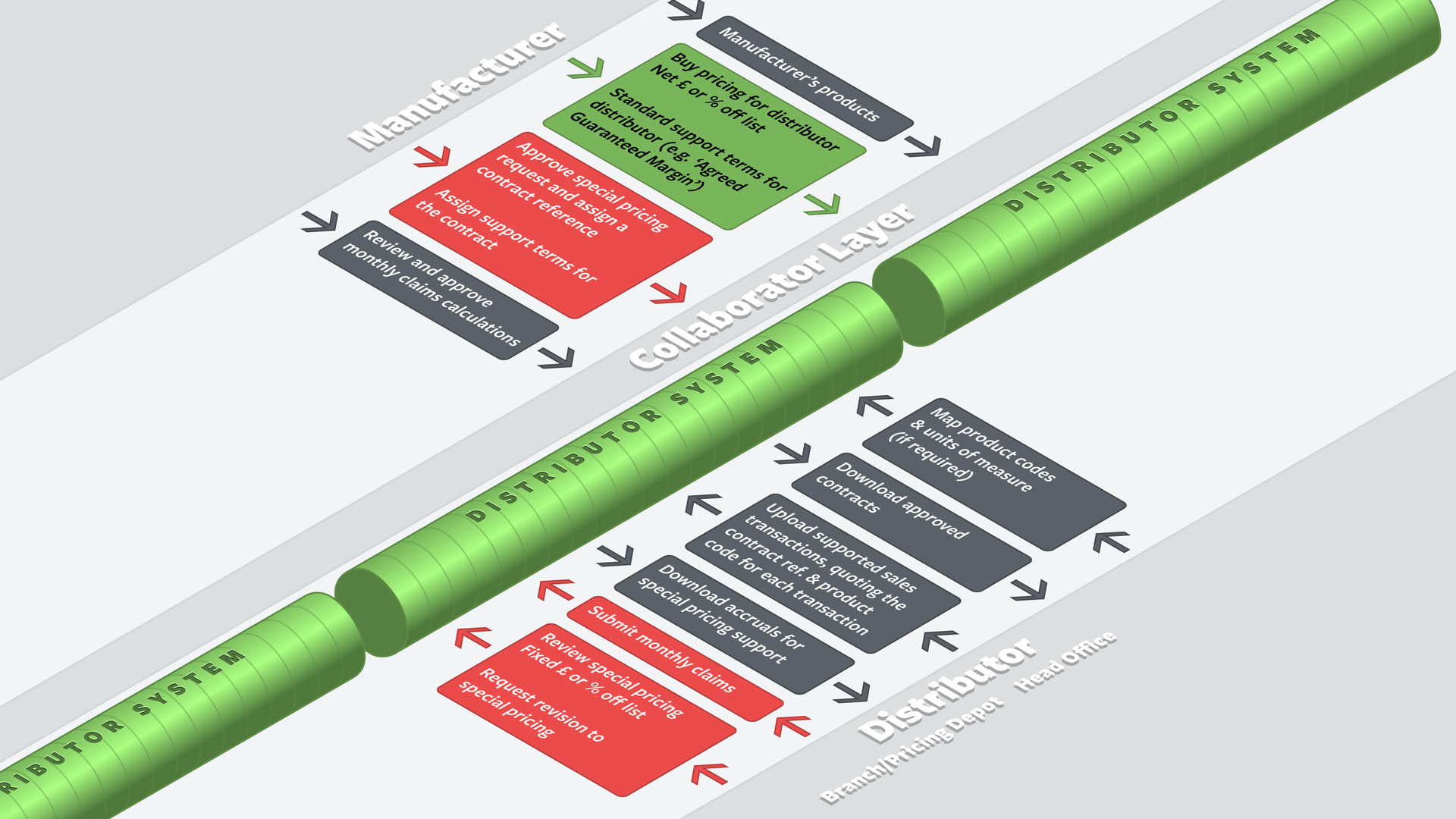

In the above diagram we can see some typical agreements between manufacturers and distributors. Manufacturers often provide discounted prices to distributors based on agreements, without rebate or SPAs distributors often sell above their buy price to gain some sort of profit. With special pricing agreements however, they can sell below their buy price knowing they have the luxury of support, now their profit becomes the difference between their sell price and the level of support they can negotiate on top of their discounts. The manufacturer will finish at a net net price that still provides them a sustainable profit.

Why do special pricing agreements exist?

Special pricing agreements allow a manufacturer to drive sales through ‘supporting’ the pricing of their products to a given end customer. The strategies behind this can be varied, including supporting a distributor who already has a great relationship with the customer, guaranteeing the end customer a predictable and attractive price whilst they are still at design stage with their project, and supporting a distributor who is putting sales effort into winning some new business. Allowing a manufacturer to operate in the competitive landscape by investing in growing their market share is the primary goal of special pricing agreements.

What are the challenges of special pricing?

Because special pricing agreements are highly targeted, many individual pricing agreements might operate between a manufacturer and a distributor, with new agreements being instated frequently through the year. Combined with the challenge of frequency and volume, SPA funding is calculated and ‘claimed’ retrospectively, where the usual process is for a distributor to make monthly claims on their manufacturer partners.

Duplication of effort is a monumental obstacle in the operation of a successful SPA

As part of these claims, the distributor is expected to provide supporting evidence or data on the sales for which they are claiming special pricing support and the pricing quotations under which the support had been agreed. With GDPR considerations this has become increasingly more problematic.

One challenge that arises involves product mapping. special pricing agreements are typically agreed in the terms of the manufacturer, leaving distributors struggling to match their relevant product codes to the manufacturer’s own product codes. At times products listed on the special pricing agreement may not even be coded by the distributor, but rather than miss out on these sales, the distributor is forced to use ‘special’ codes which can present their own problems.

Claims are then often submitted from the distributor to the manufacturer in the distributor’s own product codes, which again need to be mapped back into the manufacturer’s codes for proper processing.

The duplication of effort in many areas is a monumental obstacle in the smooth operation of a successful special pricing agreement, which opposes the fundamental collaborative nature of the agreement.

Further to this, due to the variety of ways in which these agreements can be negotiated and re-negotiated it is an arduous process to ensure that thorough, accurate and up to date documentation is maintained. Many in the industry miss out on large amounts of claims due to simply not having reliable records that the agreements ever existed or due to not having the information required to submit a successful support claim.

Additional layers of complexity arise from the fact that a given customer may be eligible for support under multiple separate special pricing agreements, with different manufacturers and distributors having their own rules for how this is handled, as well as the fact that SPAs regularly interact with rebate.

Agreements usually specify whether sales that are claimed against a special pricing agreement should be included or excluded from sales that qualify for rebate. This interaction is often mishandled leading to disputes. When sales that are eligible for rebate payments are claimed under a special pricing agreements they must be removed from the rebate accrual. However, if this claim is rejected for whatever reason, these sales become eligible for rebate once again, but are often not factored back into a rebate claim due to inadequate processes, meaning that justly deserved earnings are effectively written off.

All of this adds up to a complex management challenge, where the costs of administering the special pricing can seriously erode the margin benefit the special pricing agreement was designed to deliver in the first place.

What are the benefits of special pricing agreements?

Improved processes will allow distributors and manufacturers to administer their joint special pricing agreements in a seamless and fully transparent manner, reducing the administrative burden, eliminating errors and discrepancies, and encouraging sensible and effective use of special pricing agreements in the marketplace. In this way suppliers and merchants can form strategic partnerships to outcompete their competitors and increase their sales and influence in the marketplace.

Manufacturers can push their products into substantial projects at large volumes by offering cheaper prices to contractors and housebuilders. The distributors who partner with the manufacturer benefit from the large volumes that are purchased and are presented with more opportunities to upsell other products that are likely to be needed for the project — and these other products might have support themselves.

By freeing up admin teams and implementing sound processes, manufacturers and distributors can focus on negotiating the right agreements for the right products and the right defined market segment to maximize the impact of SPAs and can limit the number of disputes around claims. The commercial opportunities provided by special pricing agreements are undeniable.

The future of special pricing agreements

While it may seem on the surface that the challenges involved in special pricing agreements outweigh the benefits, they are a vital part of the industry and are here to stay. You may personally deem them to be more hassle than they are worth and think that that are a large drain on resources, but this is mainly due to inefficient and unstructured processes.

Superficially it would be simple enough to step away from special pricing agreements, but then you would be left unable to compete as your rivals would be able to sustainably offer lower prices with protected profit margins. The only solution available to the market is to improve processes and negate the challenges around special pricing agreements in order to receive maximum benefit and concentrate on commercial opportunities to utilise SPAs in your favour and gain a competitive advantage.

The ability to maintain pricing flexibility in the distribution channel offers companies an incredible advantage which extends beyond increased profit margins, but also leverages customer loyalty, proactive sales activities and essential product-line control. Any company regularly involved in special pricing agreements must allocate adequate resources to improve or automate their internal processes and focus on fostering strong collaborative relationships with their trading partners or they risk being left straggling behind their competitors.

More about special pricing agreements

- Exploring the SPA — Frank Hurtte, writing for Industrial Supply Magazine

Demystifying rebate management

If you’ve just started researching products that can help with B2B deals, you might find this 2-minute video useful.

- What if you didn’t have to wait for month-end… quarter-end… annual reconciliation of revenue and rebate? Could margins improve?

- What if you had immediate visibility into the impact of rebates? At what locations? In what industry sectors? With which customers?

Further reading

To some, income from special pricing agreements, rebate agreements or market development funds is treated as a ‘bonus’. But to other companies, these rebates form a significant proportion of their revenue and therefore warrant accurate management.

How can you ensure you keep track of your rebate contracts effectively and reliably?

Our guide will give you all the information you need to implement a structured approach to effectively managing rebates and complex trading agreements.